This Time It's NOT Different

This blog is about how to position yourself in Steel stocks presently, given ODDs are in a manner, where risk seems to be relatively lesser on the SHORT side of the trade given our weak view on domestic steel pricing scenario.

Disclaimer: This blog is not a recommendation to buy / hold / sell any stock. This blog is mainly for information and EDUCATIONAL purpose only. The intention to share write ups on this blog is to create a repository of ideas so that investors / visitors on the website / blog can have a look at various frameworks & approaches. Please read the detailed disclaimer at the bottom of the post.

Recency bias is a form of emotional bias where one tends to weigh recent events more heavily, discarding the historical events & information available. This results in failing to notice an opportunity that is in plain sight cause their attention is directed somewhere else. The steel sector is experiencing something similar right now.

Steel has always been a cyclical market, very much like other commodities. Owing to reasons such as volatility in the NSRs, iron ore prices, coking coal prices & heavy dependence on China's outlook & policies. In recent times, China came up with a policy of reducing the steel output to improve their environmental concerns which changed the narrative to a stronger steel cycle. This coupled with covid related supply chain issues led to an upcycle in global steel prices in 2020-2021. This made people believe that cyclicality in the steel segment is something of the past and the margin band will be higher than the past, on sustainable basis. With China not exporting much, the global steel sentiment would change to a newer less cyclical market. This is the kind of story that got built up. But in reality, the exports may drop in the long term but what matters in the steel cycle is near-term to mid-term. While one should have a long-term narrative on where the sector is headed, but because of the volatility (given cyclicality), near term moves also impact the sector and stock prices in a big way.

The above historical Chinese export data shows that despite the policy changes, exports have remained at an elevated level in 2022, compared to many past years and there remains a hanging risk of these exports returning anytime in the future given poor demand from China property and infra sector. And that's just one factor. Volatility in the raw material prices (iron ore, coking coal) heavily impacts the spreads for steel companies.

Along with that, lack of clarity regarding the steel prices reduces the visibility & viability of the top line & bottom-line projections. Thus, it would be right to state that the macros for the sector remain intact as the past and the cyclical nature of the industry has not been discarded owing to these minor changes.

Steel was/is/will remain cyclical for the time being. With that thought bolted in our head, lets look why there exists scope of correction in the steel markets.

China, Japan & Korea are the 3 countries from which India imports the most. Historically, domestic steel prices always follow landed import prices. Remaining either at a discount or par.

Source: Kotak India Daily, Centra Advisors

Note: India has an FTA agreement with Japan and South Korea and imports from them attract NIL duty. Also, the above calculations are for HRC grade of steel.

Currently, domestic steel prices are running at a heavy premium to landed import prices from all three countries, since Q3 and Q4 are the strongest months for infra sector and the mills think they will be able to command higher pricing and they anticipate some uptick in regional pricing which can narrow this premium. At the current run rate of 56,100 ₹/ton, they attract a premium of 3437/8970/8154 ₹/ton from China, South Korea & Japan. Market economics won’t let these differences continue for a longer period, the domestic prices have to be at import parity. Thus, a fall in domestic steel prices is inevitable. Despite of removal of export duty, weak demand sentiment in China and Europe (energy crisis led demand destruction) has kept the prices subdued. We believe we can see a downfall in prices up to the extent of 5000/tn over the short term (2-4 months, if not earlier) at present cost sheet assuming RM prices are the same, which will bring stress to present spot EBIDTA levels. We assume any softening in RM basket, will lead to additional fall in NSRs given poor demand. This will lead to decay in the producer’s spreads over the period.

Keeping all these points in mind, now we would like to focus explicitly on the second-largest steel company in India, JSW Steel Ltd.

JSW steel did revenue of ₹146,371 crores & EBIDTA of ₹39,007 crores in FY2022. Its market capitalization stands at ~₹180,000 crores & Net debt at ₹65,719 crores as on today.

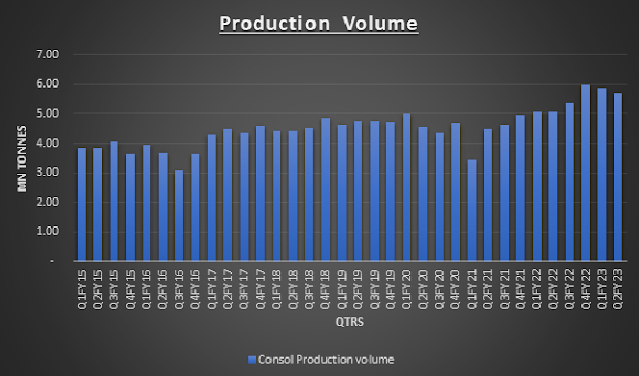

Through organic & inorganic expansion JSW Steel has almost doubled its capacity to ~34mntpa from ~18mntpa in 2015-16. The quarterly run rate which was under 4mntpa has now increased to ~6mntpa. It also has plans to increase this capacity to 37mntpa by FY2025. Despite all this, the question to be asked is, what's already priced in the current valuation?

Volatility in the realizations & EBIDTA/tn makes it difficult to project the top line & bottom line of the company over the years. Being in an industry that requires heavy capex to keep up with the growth, the inconsistency & volatility in the earnings makes it tough to generate FCF for a continuous period.

Source: Company’s presentations, Centra Advisors

Source: Company’s presentations, Centra Advisors

Steel sector (and JSW Steel) has had huge spikes in its realizations & EBIDTA/tn but over time it always returns to its average level which continues for mid-term. This is the definition of cyclicality: short-term spikes followed by mid-long terms stable prices & spreads. The above data proves that as well. With all the spikes & bottoms in the steel cycle, the realization band has been in the range of 35-85k/tn and the EBIDTA/tn has a band of 3-23k/tn. This quantum of movement makes the earning projection process nothing less than a gamble. It’s worth noting that such low visibility and volatility of earnings resulting in frequent change in assumptions is a prime characteristic of a cyclical company and its never going to be any different than that. And hence what level of earnings to use for valuations is going to be a KEY factor in deciding whether ODDs favor you in that trade.

Now to show how street has valued the company over different cycles, below table helps to gather an idea regarding the implied EBIDTA/tn street priced in at different point of time.

For detailed understanding, five inflection points have been identified at different stages of cycle that was played out from 2015-today.

Considering 1 year forward volume scenario and at an EV/EBIDTA multiple of 6x we have tried to get the implied EBIDTA/tn which street valued at that point of time i.e., what level of EBIDTA is getting full valuations of 6x, considering the fact about what numbers the company delivered in those quarters and what were the near-term outlook then. Through above table, we can see that the mean implied EBIDTA/tn has remained in the range of 9-16k at various stages of cycle. The JSW got valued at EBIDTA of 9k in a downcycle, at EBIDTA of 12-13k in a mid-cycle and at EBIDTA of 15-16k in an upcycle.

Currently the company did EBIDTA/tn of 3k (in Q2), and in Q3 is expected to do around 9-10k. And with a view of falling domestic steel prices to the extent of 5k/tn, we think there is a risk to this EBIDTA run rate. Hence implied EBIDTA/tn of 14k appears to be overvaluation in the near term. This makes it quite clear that the company is running at a valuation which is at much premium over its historical price, or inversely the stock is implying huge improvements in steel cycle and its EBIDTA trends in the near term, which we think is not happening any time soon given the risks mentioned above.

Downside Risks to the stock price:

1. Correction in domestic prices

2. China not opening up, zero covid policy continuing for longer, leading to higher China exports

3. Subdued global demand due to recessionary trends and high interest rate regime

4. Energy crisis

5. Debt levels may spike up owing to depressed earnings and huge capex commitments

Upside Risks to the stock price:

1. China reopening at a faster pace

2. Steel cycle getting closer to what it was in 2021

3. Recession not lasting longer

Also looking at where the overall market stands (18800 nifty), we anticipate sharp fall in the stock prices of JSW Steel as and when nifty falls too. Remaining vulnerable to cyclicality of the markets, JSW Steel stands at the point where the fall in prices would be eating up to a large amount of its spreads. A 2k drag in the implied EBIDTA will make the stock price plunge to a level of 600. All the events are pointing towards the same direction.

To us this appears to be a low-risk trade, given its building in price levels that we saw in 2021 super cycle, and there is no such trajectory that we foresee in the next 2-3 quarters that can justify the present rich valuations.

Given the above view, we think ODDs clearly favor going short on JSW Steel. Longs will not make money especially the Buy and Hold ones, and traders with long position carry massive risk in our opinion.

Thank You

Authored By Archan Pathak

Moderated by Jeet Gala

Source of the data:

Some of the data used in this blog is created by Centra, while some data may have been fetched through various websites, content, files, brokerage house notes, etc. available freely on the social media.

Disclosure:

The above blog is ONLY for EDUCATIONAL purposes. The information herein is used as per the available sources of exchanges, company’s annual reports & other public database sources. Centra Advisors is not responsible for any discrepancy in the above-mentioned data. Investors and readers of this blog should seek advice of their independent financial advisor prior to taking any investment decision based on this blog or for any necessary explanation of its contents. The blog is based on personal opinions & views of the author. Readers are responsible for all outcomes arising of buying / selling of particular scrip / scrips mentioned here in. This report indicates opinion of the author & is NOT A RECOMMENDATION to buy or sell securities. Centra Advisors & its representatives may or may not have any vested interest in above mentioned securities at the time of this publication. Centra Advisors, or it’s associates are not paid or compensated at any point of time, or in last 12 months by any way from the companies mentioned in the report. The views expressed in this post accurately reflect the authors personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.