We are tracking this sector for last 3 years, and we believe this sector now needs big attention especially because we believe the sector is going to come out of one of the biggest down cycle ever in any commodity. We will take you through how shipping industry works, and how well the supply side is placed, over the next 5-7 years, which can create a sustainable bull market in our opinion.

Introduction:

Shipping is the lifeline of global trade. The shipping industry has a long history, with the first cargoes being moved by sea more than 5,000 years ago to now where 85% of global trade occurs through sea routes. The shipping industry has gone through huge changes in past centuries and even in the last 30 years too.

With this small introduction, we will now take you through the entire shipping sector.

Let us break up our entire blog into 6 main parts:

1. Shipping Concepts

2. Demand Side

3. Supply Side

4. Fuel, Freight, Costs & Asset Pricing

5. Investment Opportunities

6. Summary

1. Shipping Concepts

To understand the shipping industry, it is very important to understand the different practices and different concepts attached to it. We will try to touch upon most of these industry terms, with as much clarity. These concepts will help you relate how shipping companies position themselves (within various options that they have), which usually portrays the character and strength of each of the shipping players.

A. Broad Categories of Ships:

There are different categories of ships for moving different types of goods, because each category is specifically designed for different types of goods, and hence interchangeability in use of ships for some type of goods is not possible in most of the times. The capacity of the ships is mentioned in dwt i.e., dead weight tonnage. Each ship differs in size, capacity, etc.

Ships are broadly categorized in the following types:

• Tankers

o Crude Tankers (dirty tankers)

o Product Tankers (clean tankers)

o Gas Tanker

o Chemical Tankers

Crude tankers move crude oil (raw hence called dirty) from exploration places to the refineries. Product tankers move all refined oil products (like gasoline, jet fuel, kerosene, etc., hence called clean) from the refineries to the places where demand is. Gas tankers move gases like LPG or LNG from one nation to another, and because most of them are liquefied, their entire structure is very different from a normal ship.

• Dry Bulk

Dry bulk ships move commodities like coal, iron ore, steel, aluminum, bauxite, soy beans, scrap, grains, etc.

Source: Clarksons

• Containers

Container ships are designed very specifically to fit containers on them which usually have goods like vehicles, white goods, capital goods, etc. The containers are usually measure in TEUs.

B. Tramp and Liner business:

Entire shipping industry is broadly bifurcated into 2 main structures i.e., Tramps and Liners.

Liner Service is a service that operates within a schedule and has a fixed port rotation with published dates of calls at the advertised ports i.e., sailing happens on predetermined routes. A liner service generally fulfills the schedule unless in cases where a call at one of the ports has been delayed due to natural or man-made causes.

Example: The UK/NWC continent container service of MSC which has a fixed weekly schedule calling the South African ports of Durban, Cape Town and Port Elizabeth and carrying cargo to the UK/NWC ports of Felixstowe, Antwerp, Hamburg, Le Havre and Rotterdam.

Tramp service or tramper, on the other hand, is a ship that has no fixed routing or itinerary or schedule and is available at short notice (or fixture) to load any cargo from any port to another port.

Liners usually carry container cargoes, FMCG, consumer products etc., while tramp carries oil, oil products, chemical products, LPG, LNG, iron ore, coal, grains and other minor bulks.

C. Type of Freight Markets:

Freight is what a ship earns by renting itself out to someone. Freight for liner model is usually fixed and pre-determined based on the itinerary while freight under tramp business is usually divided into 2 parts:

Time Charter:

A time charter is a time-bound agreement, as opposed to a voyage charter. The ship-owner leases a vessel to a charterer for a fixed period, and they are free to sail to any port and transport any cargo, subject to legal regulations. In time chartering, all responsibilities lie with the charterer, from paying all the expenses to obtaining necessary permissions. The agreement can span anywhere from few days to few years.

Since the freight rates are decided at the beginning and are mostly fixed in nature, this type of contract does not have any exposure to spot freight rates, once the rates are locked in for the period of journey. These contracts give you higher visibility on cash flows expected from the ship for any period of time, and hence the volatility in the earning projection is low to nil.

Some PROs and CONs:

• Provides revenue visibility and cash flows for safety.

• Lesser risk

• Volatility of the freight market doesn’t affect the topline.

• Fixation for long period can lead to losing opportunities in spot freight

• Fixation at weaker market condition can lead to potential weaker cash flows.

Voyage Charter (spot market):

A voyage charter is a type of charter in which a vessel is leased out for a particular voyage / trip. The charter agreement lists the ports of call, destination, and restrictions on cargo if any. In voyage chartering, the ship-owner undertakes payment of fuel, operation, and employment-related costs. Besides, the owner must also pay costs such as berthing and loading operations.

Since, most of the voyages range from 10 days to 45 days, freight rate is technically getting reset 10-15 times in a year. This means that you are exposed to spot freight rates as and when a reset happens. These contracts give you lower visibility on cash flows expected from the ship for any period of time, and hence the volatility in the earning projection is very high.

Some PROs and CONs:

• Being in the active spot market helps to know the pulse of the freight industry

• Enables to take benefits of the whipsaws that has led to higher freight rates

• Can ride on the volatility

• Risk of operating even below OPEX in weaker market.

• Low revenue visibility

• Only companies with strong balance sheet can take the risk of being in spot

D. How is TCE calculated?

TCE (Time Charter Equivalent) is a standard shipping industry performance measure used to compare periodic changes in shipping performance across all charter types. It is a measure used to calculate average daily revenue performance of a vessel.

TCE = (Voyage revenues – Voyage expenses) / Round trip duration in days

Voyage expenses are mainly fuel and the costs related to maintaining the crew onboard.

Example: A voyage for 30 days has been fixed at $15,000 per day and voyage expenses come around $6500 per day then TCE $8500 per day.

TCE is also sometimes referred to as TCY (Time Charter Yield)

E. Shipping speed:

Shipping like any other automobile, moves at a particular speed in the waters. Speed depends upon the usual consideration like adhering regulations, maximizing fuel cost efficiency, type of fuel used, etc. Following is the speed at which usually the ships move:

1 knot is equivalent to 1.852 kmph.

Source: Industry Reports

At the design level, bigger container ships with less speed are being constructed to obtain less CO2 emissions per container. At the operational level, the practice of reducing speed as a response to depressed market conditions and high fuel prices known as slow steaming is being used in almost all commercial shipping sector. In slow steaming, a container ship travels at a speed of around 12-19 knots instead of the usual 20-24 knots.

F. Timing the Assets:

Unlike other sectors where a fixed asset acquired is supposed to last for a long time, in the shipping sector that does not apply many times. The shipping assets may be called as fixed assets although they are more of floating in nature, and you can also rejig your shipping fleet quite easily and can upscale or downscale the capacity with ease because of existence of a deep secondary market for ships. Like any other investment, it’s all about setting your denominator as low as possible in calculating returns on investment. That's what makes the timing of buying-selling of ships a skill which very few companies are equipped with.

Buying and selling of the ships needs to be TIMED well, so as to effectively carry out trading. This is a key skill in shipping because of volatility in freight rates as well as shipping assets. Mistiming can lead to disaster.

Example: If a company bought a ship in 2008 for $95mn when asset prices for new build and secondhand were highest and in the upcoming years owing to GFC the freight rates dropped largely from around 70,000$/day to 20,000$/day and also asset prices bottomed to 65mn$. As a result, the company couldn't even generate earnings by operating or even selling the ships.

Buying the ships at the bottom and trading the ships helps you modernize the fleet while earning capital gains which is a key skill required mainly during the bad times (in the sector since 2008). Shipping asset prices are also volatile as freight rates. Hence timing them, is crucial for superior outperformance.

Selling is more difficult job (in hindsight) to catch the top, hence the companies try to exit in or around the top range.

G. IMO & Other regulations:

The shipping companies have to undergo and adhere to various regulations. Recently, the shipping sector (like any other sector) is forming regulations to cut down carbon emissions from the shipping activities. We list down few of them, which are crucial for analyzing, as we try to understand this business:

• Ballast Water Treatment System (BWTS)

o Ballast water is taken on board by ships for stability and contains thousands of marine microbes, animals and plants.

o BWTS treats ballast water to control transfer of invasive marine species

o From 01.09.2019, ships need to treat their ballast water with BWTS when they go for dry docking.

o This will in turn add to the costs and also take out supply whenever dry docking happens.

o Cost of getting BWTS done is ~$1 million per ship depending upon the size.

o A lot of ships are due for dry docking and hence BWTS over the next couple of years will put cost pressures.

• IMO2020

o Every shipping company has to reduce sulphur emissions from 3.50% to 0.50% starting 01.01.2020.

o This can be complied by either fitting scrubbers or using low sulphur fuel

o Scrubbers cost approx. $2-5 mn depending upon the size

o Usually, scrubber economics favor larger vessels that consume more fuel

To comply with IMO2020, the companies have to smartly choose for either of the 2 options considering the costs, view on the freight market, off-hire time (when ships go to the dockyard) and their own fleet expansion / renewal plans.

• IMO2030

o IMO 2030 carbon emission norms mandates CO2 reduction in “work transport” category by 40%.

o This puts a deadline beyond which some categories of ships may not be allowed to sail.

o This in turn puts ambiguity towards ordering a new vessel today resulting in low order book.

o Asset prices of vessels (not ecofriendly) may dip as we approach 2030.

o To comply with these norms, there should be clarity around the new propulsion systems which adhere to 2030 norms and similar readiness to build such ships at the shipyards must be there.

With these points, we think IMO 2030 is going to create a big confusion around what to order and this will keep the ordering low.

• Emissions Trading Systems (ETS) 2022-23

o As few firm steps towards achieving GHG targets set by IMO 2030, IMO will come out with ETS systems to keep a check on carbon emissions

o There is very little clarity around these norms yet, but these regulations are going to create tough times for the ageing and non-environment friendly ships.

• IMO2050

o IMO 2050 carbon emission norms mandates CO2 reduction in “work transport” category by 70% and overall GHG reduction by 50%.

o This is a little far-fetched, but industry is starting to prepare to move towards a low carbon emitting sector.

o In this regard, we find a lot of disruption to happen to the sector, for which the sector may not be ready.

IMO 2050 along with IMO 2030 will play its role is keeping the supply tight.

• Surveys

The ships at a particular interval have to undergo various surveys like marpol, SOLAS, etc. Dry docking survey are the toughest and most expensive and usually have to be done once in 5 years up to the age of 15 years, and then increased to twice in next 5 years. Basically, as the vessels get older, the survey costs become a bigger part of the cost sheet, and hence surveys do become an important part in decision making of ageing fleet.

H. How to play a shipping cycle:

Shipping like any other cyclical commodity needs to be timed well. The present bear market has lasted for 13 years and still ongoing, which means that if you get your foot wrong, you can head for heavy losses / bankruptcies. In short summary, we will tell you how a shipping cycle is typically played out.

|

Step

|

Point in Cycle

|

Action

|

|

1

|

During a long down cycle

|

Cash management is key

|

|

2

|

During a long down cycle

|

Buy the ships right (value buying)

|

|

3

|

When the freight market start recovering

|

Ride the ships well – spot

|

|

4

|

When the freight market is in nearing the end of bull

market

|

Ride the ships well – time charter

|

|

5

|

When the freight market peaks out

|

Sell the ships right

|

|

6

|

During the down cycle, post bust

|

Back to cash management

|

J. Crucial Shipping Routes / Passages / Ports:

There are numerous shipping routes, however we would just like to mention few of them, which have big relevance w.r.t volumes they carry and how strategically and geographically important they are.

1. Suez Canal

2. Panama Canal

3. Cape of Good Hope

4. The English Channel

5. Strait of Hormuz

6. Strait of Malacca

7. Bosphorus Strait

8. The Danish straits

9. Saint Lawrence Seaway

In the recent Suez Canal incident, a 12-hour route connecting the east and the Europe got elongated to a 14-day trip. This is how these routes are important and any event can cause spike in freight rates.

2. Demand Side:

The demand side consists of ships carrying crude oil, refined crude products, various dry commodities, containers-based products and gas. We need to have a view on each of the segments to take a view on the overall shipping and individual specific categories-based ships.

The size of the global shipping (sea borne) industry is more than 12bn tonnes. In the past 30 years, global trade has tripled. The average growth rate has stayed around ~3-4% and only thrice, in 1998, 2008 and 2020 the growth has ever been negative (during economic events), and we expect them to grow at ~4% in the future years.

More important term of the shipping industry is tonne-mile as it considers the geographical location of the buyers and the sellers. One tonne-mile is the equivalent of shipping one tonne of product for one mile.

Source: Clarksons

This chart is crucial since it has a direct correlation with higher increasing volumes (as per the earlier chart) and increase in any distance, which is measured in miles. Tonnage volumes are more volatile than the miles, since various industries have been put up defining buyers and suppliers across the globe for various sectors. Higher the ton-miles, higher the revenues. In the last three decades, the tonne-miles have doubled from 30,000 to 60,000 bn ton-miles with an average growth rate of ~4%. We expect the tonne miles to growth at an average of ~4% in the future years.

Demand drivers mainly consists of:

• Crude Oil

• Oil Products (Refined)

• Iron Ore

• Coal

• Minor bulk

• Gas

• Chemicals

• Containers

Let us now look at the following charts:

Source: Industry Reports

Source: Industry Reports

Dry bulk segment includes iron ore, coal (coking + steam), grains and other minor bulks.

• Tonnage wise crude oil segment has 16% share vis a vis a 17% share in tonne-miles

• Similarly, oil product segment has 8% vis a vis a 5% share in tonne-miles

• Chemical and gas tankers segment have 7% vis a vis a 7% share in tonne-miles

• Vice versa, containers segment has 16% vis a vis a 15% share in tonne-miles

• Also, dry bulk segment has 53% vis a vis a 56% share in tonne-miles

This individual proportions do keep changing, based on demand and supply reactions in each segment. Hence shipping needs to be seen in isolation to each category. We expect this growth in trade volumes to be maintained at an average of ~4% in the future years. With this small background, we will take you through each segment briefly.

A. Crude Oil:

Crude oil is a global commodity with production rate at ~100 mn bpd (barrels per day). With covid, the demand has temporarily reduced to 95 mn bpd, impacting the tonnage and the tonne miles, putting pressure on the freight rates. Below is the mapping of crude oil production, and major importing and exporting nations.

Source: Clarksons

We can observe that ~42% of the global crude is subject to trade i.e., shipping. Most of this crude oil goes to refineries for various products and applications. We can observe that the share of US in the exports is going up and is expected to go up further. Overall crude production may remain constant but we expect the export to grow further eventually increasing the tonne miles.

Source: Clarksons

Crude segment has grown at an average of 2% in the last 20 years. We expect this trend to continue in the future years too.

B. Oil Products:

Oil products are products that come out of the refinery. Oil products that are moved comes to ~25 mn bpd (approx. 25% of crude production).

Source: Clarksons

Source: Clarksons

As you can see from the chart above, the oil products segment is steadily growing at ~4% and expected to grow in future too at the same rate, given the demand for various crude products i.e., gasoline, jet fuel, kerosene, crude derivatives and other petrochemical products.

C. Dry Bulk:

Dry bulk segment carries iron ore, coal (coking + steam), grains and other minor bulks.

Source: Clarksons

Iron ore and coking coal relates to steel industry, while steam coal relates to power/energy industry.

Source: Clarksons

We are not dwelling upon each sector (i.e., steel, power, other commodities, etc.) in detail, but we believe that overall shipping demand growth rate in tonne-miles will continue to grow at more than 4% over the next few years similar to the growth rate in the last 20 years.

3. Supply Side:

In terms of dead weight tonnage (dwt), the global shipping industry is a 2.14bn dwt industry as given under:

Source: Clarksons

In the past 20 years, fleet size has almost tripled (not a single year of de-growth), at an average growth rate of ~4.5%. During boom (2003-2008), the growth rate was in higher single digit because of high number of fleet orderings took place, but post 2012 as the market has been weak even the growth rate has been subdued.

Breakup of this 2.14bn dwt is given as under:

Source: Industry Reports

An average age of ship is around ~20 years for dry bulker, ~22-25 years for a crude and product tanker and up to 30 years for gas tankers. At the end-of-life cycle, the ships are sent to scrapyard and demolished which leads to reduction in the global fleet size.

Most important supply drivers that have an impact on the global fleet are as under:

• Fleet Composition

• Order Book

• Contracting

• Deliveries

• Scrapping

• Shipyards

• Slow Steaming

• Ships used as storage

PLEASE NOTE:

I. Our investment hypothesis is for a company which has zero exposure towards containers and other smaller segments, and hence in all our calculations and charts we will keep only 4 main segments i.e., Crude tankers, Product tankers, Dry Bulkers and Gas tankers.

II. The segments which we are talking about aggregate to 1.67bn dwt out of the total global 2.14bn dwt fleet.

With this introduction, we will take you to each supply drivers.

A. Fleet Composition:

Understanding fleet composition is the key step towards taking a view on the supply side. Following chart helps us understand the breakup of the ships (that are in existence today) by year of their birth.

Source: Clarksons

This chart says that ~9% or 145 mn dwt out of the world fleet today was born in 2011, and so on. This helps us to know the age profile of the existing ships. With the above data, we try to categorize the age group as under:

Source: Clarksons

There are a lot of ships (7%) in existence today which are born prior to year 2000, which are eligible for scrapping. Furthermore, during the last upcycle, a lot of new ships were added and ~400 mn dwt (24% of existing fleet) was added in 2010, 2011 & 2012. This major block of ships will go out in one go, somewhere at the end of this decade.

Source: Clarksons

The above chart shows life of a ship i.e., how many % of fleet that was born in each year is still alive? For eg: 100% of the fleet manufactured in 2005 is still alive as on today; 60% of the fleet manufactured in 2000 is still alive as on today. And so on… This shows how ships after turning 17-20 years old start getting scrapped. Scrapping accelerates once they turn 20-year-olds, because of age, compliance costs and quality issues. Gas tanker have the highest life followed by product tankers and then crude and bulk.

The majority portion which is ~55% of the total world fleet were built during the past 10 years. But out of the remaining 45%, significant 20% of the total world fleet are aged 15 years & more. Thus, these are the ships whose life cycle is coming to end and they cover a major portion of global fleet.

B. Order Book:

Order book means % of fleet that is on order (given to the ship yards by the ship owners).

Source: Clarksons

Closing order book = Opening order book + New orders (i.e., contracting) – Order delivered (i.e., deliveries)

Average lead-time for a ship to get delivered is 2-3 years from the date of order, which means annually 60mn dwt of fresh fleet supply is expected in the market over the next 3 years (180mn dwt order book / 3 years).

The order book as a percentage to the global fleet went as high as 60% in the last boom in 2008 period, which led to an oversupply of ships in the future years.

The blended order book as on today of 7.20% is the lowest seen in the last 25 years. The segment wise latest order book position (% of fleet) as under:

|

Crude

Tankers

|

8.84%

|

|

Product

Tankers

|

6.94%

|

|

Dry

Bulk

|

5.59%

|

With the sector being in the bear market, with depressed freight earnings outlook, over supplied market and unavailability of bank finance (higher margins and low tenor shows risk averse attitude towards the sector) the present order book is at all-time low. Also, no clarity towards IMO 2030 norms regarding the ship propulsions systems also keeps the new ordering low, since life of a ship is usually around 20 years, and the sector is going to face a disruption around 2030.

We expect the order book to remain low which will keep the supply tight.

C. Contracting:

Contracting refers to new orders placed during the year.

Source: Clarksons

Whenever the shipping industry earns the most, it orders the most. In 2007, ~25% of global fleet then was contracted in a single year and vice versa happens whenever earnings reduce. Contracting rate has reduced to ~2.50% p.a. of the global fleet size, due to various reasons already mentioned above. We expect contracting to remain soft even as freight increases, keeping in mind IMO2030 norms. Contracting is not expected to catch up, whenever freight market recovers.

D. Deliveries:

Deliveries refer to ships that were delivered in that particular year. Deliveries are a direct function of execution of the order book.

Source: Clarksons

As mentioned earlier, average lead time for a delivery of a ship is close to 2-3 years. Hence contracting done in 2007-2008 were delivered in the period 2009-2012 (period of bust). Lower deliveries are due to low sentiments in the sector, which also directly affects the business of the shipyard who are building these ships (dip in the number of active shipyards). With low order book outlook, the deliveries are estimated to be soft. In absolute terms, we think the deliveries will be under 50mn dwt in the coming years. Deliveries effectively add to the supply.

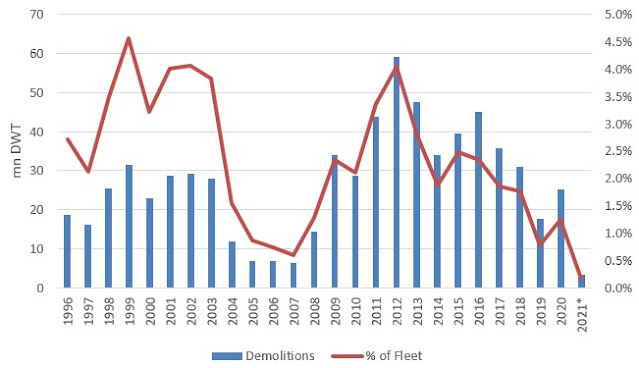

E. Scrapping:

Scrapping refers to dismantling of ships, whenever their economic use comes to an end. Scrapping may be because of old age of the ship, various compliance costs, effective quality and rising scrap metal rates. Scrapping effectively tightens the supply.

Source: Clarksons

Scrapping is low during boom (2003-2008), and usually picks up as the ageing happens and the market is depressing. As the freight rates are high, ship-owners postpone the scrapping of ships by 1-2 years because they are able to earn high enough to match the costs. Scrapping gets you anywhere from 15-20% of the original ship cost. The scrapping has reduced over the last 2 years on account of Covid19 disruptions and probably some enthusiasm on short term recovery in the freight market.

Scrap metals prices have risen recently on the back of strong recovery in the steel sector.

Source: LME

In the chart above, there is a recent rise in scrap metal prices, which provides a good option to scrap the ships as compared to sailing in the depressing freight market, when you know you have just few years of life left in the asset.

From the fleet profiling charts showed earlier, we anticipate that scrapping of ships older than 20 years i.e., 8% of the global fleet should happen quickly over the next 1-2 years. Further, we can see that a big scrapping will happen of ships born in 2010-2012 (26% of global fleet) by the year 2027-2030. This will cause a big demand supply imbalance in our opinion, and structural bull market.

We think the scrapping should pick in the going years on account of the following:

o Ageing profile of the fleet

o IMO2020 fuel norms mandating use of low sulphur fuels or using scrubbers that add to the operating expenditure

o BWTS and ETS regulations putting cost pressures

o Higher scrap metal prices

o Extension of weak freight market

Most of the scrapping activity happens in India, Bangladesh and Pakistan given the laborious nature of the activity as under:

Source: Industry Reports

F. Shipyards & Shipbuilding:

The shipbuilding activity is carried at shipyards, and most of the steel making nations like China, Korea and Japan dominate this sector.

Below is the snapshot of number of active ship-building capacity and number of shipyards globally.

Source: BRS Group

As on today, there are close to 275 shipyards with total capacity of 175 mn dwt as compared to 685 shipyards with total capacity of 320 mn dwt in 2007 peak. More than 50% closure of capacities have happened during this downcycle, and we are back to 2003 levels.

Following chart shows the number of yards which have received last order in respective years. i.e., 60 shipyards got their last order in 2015 and so on.

Source: MSI

A lot of these smaller yards have been mothballed and they will find it difficult to come back again.

Source: BRS Group

As on 2019, we can see above, how only 10 players contribute to ~75% of the shipbuilding capacities. You can now corelate as to how low ordering during the last 12 years have contributed to the stress among the ship building sector, where in a lot of capacities got built in the 2003-2008 period have slowly started to retire / mothball and how difficult they find in getting ship orders.

We believe this concentration will continue, as weaker and smaller shipyards will still continue to consolidate in the sector. Further, mothballed capacities will not find it easy to come back as and when the sector bounces. This is coupled with the fact that how IMO2030 and IMO2050 creating ambiguity around the new ship technology in propulsion systems will lead to slow supply response to growing demand.

This supply factor in our opinion will keep ordering and deliveries low.

G. Slow Steaming:

Slow steaming is a concept when speed of the ship is reduced when markets are depressing with an eventual goal to increase the TCY. The behavior of the shipper is as under:

Source: Centra

Following is an approximate math as to how slow steaming increases TCY.

Slow steaming has an effect of tightening the supply. A 13-knot speed reduced to 12-knot speed effectively increases number of days by ~5%, which is huge in our opinion. Post 2008 boom, the shipping speeds have reduced drastically by 15-18% for dry bulk and 20% for crude and product tankers. This automatically tightens supply in an already over supplied market. Slow steaming results in reduction of engine power and fuel consumption, but results in higher voyage days. Effectively, slow steaming is taken up to increase TCY.

We believe this is more scope to cut down shipping speed and resort to slow steaming since the freight markets are stressed presently.

H. Ships as storage:

Ships for its given size and structure is often used as a storage play as mentioned below:

• Contango is a situation where the future price of a commodity is higher than the spot price

• In such situation, traders store the commodity (after taking the delivery) and sell it in the forward market

• During the period of the contract, these commodities (mainly crude), gets stored on the ships, because most of the land storage usually gets filled completely during such contangos

• In such situation, demand for larger ships (like VLCCs) increases, which technically tightens the freight supply market increasing the freight rates

• Ships once sucked for storage may not be available for 3-4 months, till the time the commodity is delivered to the end user

• Such tightness in ships sometimes creates a euphoric bull market, but for a brief period of time

• This reduces the supply of commodity and eventually the prices reach the level which they are supposed to be at

• Latest in Q1 of FY2021 such contango occurred (when crude dipped to sub $20) which led to freight rates rising to peak of 200,000$ per day

We think supply drivers as mentioned above have a big impact on shipping. Even a 1% demand supply imbalance is enough for the freight prices to react. Looking at all the factors above, we think that supply side is going to remain tight for the next 5-7 years, and we expect good recovery in the freight rates, assuming demand grows at its nominal rate.

4. Freight, Asset Pricing and Fuel Costs:

A. Freight:

Freight is the earnings that ships get on letting themselves out. It is the main income for any shipping company.

The major shipping indices that one should follow are:

• Baltic Dry Index:

Often called as BDI, this index is the composition of the freight rates of major shipping routes pertaining to dry bulk segment.

Source: Investing.com

Index has 40% weightage towards Capesize and 30% each towards Panamax and Supramax. In 2008, BDI touched 11000 and then crashed to 300 in 2016, which is 97% drawdown from the top. However this index has recently started to bounce back on the commodity led demand.

• Baltic Dirty Tanker Index (BDTI):

BDTI tracks freight rate for crude tankers only.

Source: Industry Reports

We can notice that present freight rates are in the bottom range. Freight rates are such low that hardly it is breaking even at operating expenditure level. Further this chart shows the volatility and swings which are big deviations from the highs and the lows, and these happen quite frequently.

• Baltic Clean Tanker Index (BCTI):

BCTI tracks freight rate for product tankers only.

Source: Industry Reports

We can notice that present freight rates are in the bottom range. Freight rates are such low that hardly it is breaking even at operating expenditure level. Further this chart shows the volatility and swings which are big deviations from the highs and the lows, and these happen quite frequently.

The combo of all segments is given as under:

From the charts above, we can make a point that we are somewhere in the bottom of the long-term average freight prices, and even looking at the current rates, most of the segments are hardly making any profits. The freight rates have dipped by close to 80% from the top and close to 60% down from the 2003-2008 average.

However, even during the low freight rate cycle, we will find some economic or sector specific events happening which lead to strengthening of freight rates. But these rates only last for a small period (1 months to 3 months) since they are not structural improvements. But the spike is so sharp (ranging from 3x to 10x), that if you get your rates fixed at those levels, it will more than make up for the entire year. We term such events as “whipsaws”. Below is the list of few of such whipsaws that have happened in the last 12 years:

o 2005: Big surge in freight happened because of Hurricane Ivan, which knocked off a significant part of the US oil production in September and that too at a time when US oil inventories were running quite low. Hurricane Ivan was rumored to have knocked-off something like 500,000 barrels per day of US production. This led to a surge in export of oil from long haul Middle-East countries.

o 2010: Contango in oil prices led to freight rates peaking to 90,000 in VLCC market during winter months.

o 2013: Sandy hurricane led to refineries closing down in the Q3, along with the winter season it led to a hike in freight rates

o 2015: Drop in crude led contango spiked the freight rates again

o 2016: China reduced its coal import by 20%, increase imports from Australia compared to Brazil resulting into short haul trade (downward whipsaw)

o 2019: Significant congestion in Turkish Straits along with low tanker fleet growth led to rates peaking up to $50,000. Closure of Houston channel too spiked rates.

o 2020: US ban on a couple of COSCO subsidiaries, which reportedly impacted a fleet of almost 50 VLCCs; significant VLSFO floating storage build-up, even as a number of ships were undergoing scrubber retrofitting;

o 2021: Contango in crude again in Mar-April 2020.

Only shippers, who operate on spot market can take the benefit of such whipsaws.

Looking at the demand and supply factors, we think the freight rates have scope to only go up. In our opinion, we believe there will be structural improvements in freight rates which can last for 2-3 years creating bull cycle in the freights again. In absolute terms the freight rates can very well test it previous highs and go back to the 50,000/day range and sustain. There is no scope for it go down further, it can only not improve for few more years before it starts to pick up.

B. Asset Pricing:

The asset pricing is usually evaluated with 2 categories i.e., new build pricing and a 5-year-old second hand asset. The pricing between these 2 categories depends upon the purpose and how quickly you want the asset to be delivered to you and it is also a function of freight rates and volumes in secondary market.

Following the asset price chart of new build for the last 25 years:

Source: Clarksons, Centra

New build prices in tankers and bulkers segment had almost doubled during the last boom period between 2003-2008 while it is now back to 2003 levels. From here, the new build prices still have some room to go a bit lower (looking at past averages), which is when probably support levels from value buying may emerge.

New build ship prices are impacted directly by mainly two factors i.e., freight market (strong order book or weak order book) and number of shipyards present to take those orders. i.e., demand and supply economics in the ship building sector. Considering the low freight rates, and confusion around the propulsion systems, the new build prices will remain soft as the ordering is low. However, new build prices will increase a bit as a cost push due to the recent rise in steel prices.

But since new ordering will be delivered in 2-3 years, there may be scouting of ships happening in the secondary market, for which we show you the below graph:

Source: Clarksons, Centra

Second hands always trade at some discount to new builds. Discount rate narrowed for 5-year-old tankers (from 20% to almost 0%) and for 10-year-old tankers (from 45% to almost 20%) during the 2003-2008 period, since the spot freight rates were rising and demand for secondary market quick delivery ships rose (so that benefit of spot can be taken). Second hand market reacts very swiftly to the spot freight rates.

Discount has again ballooned to 30% and 55% even much below than the pre-2003 levels. This is mainly due to the stressed freight and over supplied markets.

Let us look at a similar chart for dry bulkers:

Source: Clarksons, Centra

Discount rate narrowed for 5-year-old tankers (from 20% discount to 20-30% premium) and for 10-year-old tankers (from 35% discount to a 5-10% premium) during the 2003-2008 period, since the spot freight rates were rising and demand for secondary market quick delivery ships rose (so that benefit of spot can be taken). Second hand market reacts very swiftly to the spot freight rates. 2003-2008 was mainly a commodity riven rally and hence dry bulkers had much more strong demand showing how desperate the market was for second hands in a manner that second hands were traded for higher value than the new builds which is only a function of desperation in wanting the fleet.

Discount has again ballooned to 30% and 50% even much below than the pre-2003 levels. This is mainly due to the stressed freight and over supplied markets.

Buying a new build or a second hand is based on the price points mainly and the time it takes for delivery. We think considering IMO2030, there will be a lot of activity happening in the secondary market and prices of second hands must firm up from here over the next 3-5 years. New builds will firm up when we get clarity on the propulsion systems. Also, as discussed earlier the tightness in the ship building capacities will further add to the strength in the new builds as and when the demand comes back.

C. Fuel:

There are various types of fuel which are used in the ships depending upon its propulsion systems:

o High Sulphur Fuel Oil (HSFO)

o Low Sulphur Fuel Oil (LSFO)

o Marine Gas Oil (MGO)

o LNG

o Solar / Eco ships

Fuel cost is ~60% of the operating cost. Hence it is one of the most important line items in a cost sheet.

Most of the shipping fleet is operated on fuel oil. As per IMO 2020 norms, the companies have to take a view on spreads between LSFO and HSFO and then decide on putting scrubbers.

The spreads are as under:

Source: Scorpio Tankers Presentation

In anticipation of IMO 2020, the spreads had risen to $300/tonne with an increasing demand of LSFO, however covid led destruction brought the spreads back to the lower range.

However, once the shipping activity returns, these spreads are expected to come back. Hence companies are lining up the vessels and retrofitting them with scrubbers. Following is the snapshot of the overall fleet and how much of that is scrubber fitted:

Source: Industry Report

We believe the number of scrubber fits will increase over the next 2 years as and when ships go for dry docking.

5. GE Shipping as an investment opportunity:

GE Shipping is an Indian private sector shipping company, based in Mumbai. The company is 72-year-old, and has seen many business cycles till date, to only come out stronger and bigger as ever. The company operates under 2 segments i.e., shipping and offshore.

Prior to shipping, the founder promoters (Maneklal and Jagjiwan Sheth) were carrying business of sugar trading. At one point, they used to trade 30% of India’s sugar. The key point here is the Sheths’ have always attached themselves with commodities, volatility and cyclicality.

A brief introduction of GE Shipping is as under:

• Pioneers of Tramp business:

GE has always been running its business as a tramp, and not on liner model. It has always believed in tramp even when tramp segment was not being promoted by the domestic Govt. Tramp model helps the company play volatility to its advantage. Also being in tramp, it can position its ship at any part of the world map.

• More than 2 decades of highest sustainability and profitability:

The company claims that it features in the top decile w.r.t. profitability of listed shipping companies in the word. And the company has generated positive returns for its shareholders in the last 2 decades.

• Presence in tankers, bulkers; not in containers:

GE has been dominantly operating in dry bulkers and tankers since many years. They believe that their operational skills lie in those areas and they have no plan to indulge in containers sector as it is in the hands of just few companies who dominate the sector.

Also, within tankers and bulkers, the company has a well-diversified fleet into the 4 segments i.e. crude, product, gas and dry bulkers. The company now wants to acquire more larger size vessels since they expect more volatility in freight in those segments which can create additional profit potential.

Having said that, what you also need is having multiple asset classes in the same category of assets, so then you can spread them around the globe. You can have some ships in the Persian Gulf, some ships in the East, some ships in the Atlantic, Mediterranean, so on and so forth. In this sense, GE has a well-diversified fleet.

• Trader of the ships:

GE has been a sharp trader of ships too. Trading activity helps them to make profits on ships, which helps them surf the down cycle more smoothly. Also trading lets you churn the fleet effectively strengthening the fleet profile by making it younger and high quality. Further GE is always a buyer of second-hand ships. They never order any fresh ships, because they find more value in the pricing of the second hands.

• Value Investors:

GE has always been a value buyer. Company sets a target to make at least 10% returns on an unlevered basis on its investments. Let us say if they look at a ship which is five years old and that the ship is valued at $20 million today. Then they see what is the scenario under which it can earn a 10% return (p.a.) on this investment within the next three to five years, then they model those earning numbers and analyze how the values look like in the historical context and then they make a decision based on that.

The company has underlying processes to buy ships whenever prices are at say bottom 25th percentile of the asset class looking at historical bottom and their view on the future price cycle i.e., buying assets which are priced for bankruptcy. Deal origination, evaluation and closure are critical to catch the falling knives and we believe GE is a master at this. After having bought the ship, the next target is to achieve higher operating profit/ yield than peers, putting them on top of the cost curve.

The company has set up strong internal institutional practices which helps them to time the buying and selling of the asset (acquisitions and sales), and also help them take a view on freight market, whether to remain spot or lock themselves in any good time charter opportunities. All these decisions involve taking a view and making the most out of volatility.

The company has made few mistakes in the previous cycle (2003-2008), but however they have realized it, and is very confident about not repeating them in the future.

The company will not chase growth for the sake of it, but will wait for correct entry levels whenever they acquire assets.

• Exposed to spot market:

Being exposed to the spot market in itself is a luxury which requires you to operate on negative cash flows (during a downcycle) which requires a lot of cash on your balance sheet. Further strong balance sheet helps you avoid locking yourself on the time charter (weaker long period TCYs). Spot market lets you ride any upside in the freight market, which can either be a whipsaw or a structural improvement. Hence remaining exposed to the spot market at the bottom of the freight cycle is a brilliant strategy according to us.

• Bankability:

GE has been one of the strongest shipping companies globally. Also having survived various down cycles in the sector, the company has come out stronger and bigger. With its strong balance sheet and past history, the ability to raise finance is not an issue, in period where most of the leveraged and bigger players too finding it difficult to borrow in this sector.

• Last Man Standing:

GE, as mentioned earlier, has survived various cycles, while more than 50% of the players have disappeared in the last 12 years of this downcycle. Hence, we like GE for being the last man standing and having surfed the sector strongly.

• Cash as an asset class:

The company usually sits on a lot of cash for budgeting its survival during a down cycle because most of the ship acquisitions during this period come with a negative operating cash flow. Also, keeping ample cash helps buying any shipping assets, which are lucrative and require quick closure.

o They love and welcome volatility:

GE is one of the very few companies which “times” freight market as well as asset transactions. This involves taking a view and ensuring the view is correct. The company has a very good track record in timing w.r.t these decisions. The company always has positioned itself in such a manner that it awaits volatility which is a rare welcome wish for probably any other business which wants secular growth and earnings visibility.

With this brief introduction, we will take you to more facts about the company:

1. Fleet Size:

Higher the fleet capacity, the higher the revenue. The company has been increasing fleet capacity continuously for the past decade by acquiring the correct type of ships at the right prices. Previous capex cycle was done in 2016 when the company expanded by ~50% given lucrative asset prices.

Source: Centra

The company is looking for another capex cycle under either organic or inorganic route. The company has bid for SCI which is larger in size as compared to GE. With this acquisition the company will more than double its fleet size. Also, organically, the company is assessing various assets, and may look to expand aggressively “IF” they find correct asset pricing.

Under organic route, the company may take few years to double their fleet size, but under inorganic route (SCI acquisition), the doubling of fleet may be quicker. In either case, the company is looking to grow its fleet cashing on the strong balance sheet, favorable asset prices and optimistic sector outlook.

As on today, the breakup of the fleet is as under:

2. Timing:

As we have discussed earlier about the importance of timing in the survival and outperformance in this cyclical sector, we list out few timing hits and misses by GE over the last 20 years.

One of the mistakes by GE in the previous cycle, was acquiring fleet towards the end of the top (near 2007-2008), which they were forced to cancel / sell at lower rates during 2010-2012 period. Above chart is self-explanatory, and the company is working more towards timing it ever more perfectly than ever. As discussed earlier, the company more than doubled its fleet in 2016 capex cycle, and we can see how nicely they have been able to catch the bottom. These recent acquisitions help them keep costs low, and put them ahead of peers in good and bad times.

The company has been waiting since last 2-3 years to add more ships to its kitty. Let us now see the chart below:

Source: GE Shipping Presentation

This shows that assets prices for the second hands (in crude, product and dry) have dipped over the last 1-2 years, and the decision of the company to wait for correct entry levels has been correct. These decisions are such crucial that the purchasing power of the same money has now increased by at least 25% with the drop in the asset prices.

3. Change in charter mix:

Till now we have understood that operating in the spot market is the best choice whenever freight rates are at rock bottom, and inversely, it is always advisable to lock your ships on time charter whenever there are super normal freight rates available in the market.

Not all companies have the guts and capacity to employ a majority of their ships in the spot market as it's highly volatile coupled with less visibility which makes it riskier compared to time charter.

Source: Centra

Source: Centra

If looked at the data, in the past 20 years the ratio has changed drastically, the spot market used to stay in the 20s or 30s which have now crossed 70% in tankers and 90% in dry bulk. But as it is said, higher the risk higher the returns. And thus, GE has decided to ride on this volatility as they have such a strong balance sheet that they are capable of surviving worse markets for few years. Thus, it can be guessed that if the market does well in the upcoming years, GE can squeeze tons of opportunities out of it. But that doesn't mean they are not going to take opportunity in time charter whenever super freight rates are available.

Being on spot market, company says (in quarterly analyst calls) “So you have got to really be careful on when you want to go on time charter and cover your ship for one year or six months or two years. And then you just say, okay, now I have got fixed income, and I am not going to play the volatility. Or you say, I have got the balance sheet strength where I will take the good and the bad, but my eventual average of the good and the bad will be better than if I were to lock in today for two years. And these are difficult calls to take, right? And as I said, this is what we want to get better and better at”

On timing the peak in freight and then locking it under time charter, company says (in quarterly analyst calls) “I don’t know if we will ever get the peaks. For peaks you need luck. And just like when you hit a trough, you get into bad luck. So, it is never our intention to get to the peak or to hit peaks, because that depends on luck. What we just want to get good at is so long as we can consistently capture 80%, 90% of the peaks, I think we would have done a very good job. And that is where we are focusing our energy on. We have a little team that is really working hard on trying to see how can we get better and better at this. Now on the day-to-day volatility it is much, much more difficult, having the right ship at the right time is going to be important. But having said that, what you also need is having multiple asset classes in the same category of assets, so then you can spread around. You have some ships in the Persian Gulf, you have some ships in the East, you have some ships in the Atlantic, Mediterranean, so on and so forth. So, whilst everything may not benefit, maybe you will capture X percentage of that benefit. So, I think it is a combination of luck, it’s a combination of having the fleet size and of course combination of our internal skills”

The above tells us a lot about the character of the company.

4. Average TCY ($/day) earned:

Below is the snapshot of average TCYs earned by the company over the last 20 years. This includes the mix of spot and time charter.

Source: Centra

o The company’s TCY and market’s TCY can differ as it depends on the company regarding the charter mix, availability of right ships at right time and company’s decisions how to play voyages.

o The company has been able to maintain elevated TCYs when you compare it with the spot market freight rates because, the company take benefits of whipsaws which helps the average to go up.

o As GE has its presence in all the segments, even if one of them performs (usually it does as noted in the whipsaws section), it takes care of the other sectors thus keeping the TCYs holding up

Being more exposed to spot market, we expect the TCYs to go up as and when freight market recovers.

5. Offshore Segment:

The company also operates in the offshore segment which is mainly renting out ships and rigs for oil exploration activities. This segment was demerged in 2008 and new investments were started to make again from 2009 onwards.

The profitability (EBIDTA) of this segment is reducing because of oversupply in this sector. However offshore business has always been self-sustaining and not a drain on the profitable shipping sector. (shown in the financials section)

Source: GE Shipping Presentation

There has been an under investment in the exploration and production (E&P) activities over the last decade and this is the main reason for lull in the sector.

A lot of these vessels of the company are going to come up for a reset (of freight) over the next 12 months, and the company is confident of much higher revenue from the renewed contracts. Overall, the company is expecting the offshore markets to recover since the ageing of the vessels / rigs will play out with very less new supply now coming in.

However, we just expect the offshore business to continue being self-sustaining at the current EBIDTA run rate.

6. Share Price & NAV:

Net asset value (NAV) is the market value of the business segment after reducing all the liabilities (very similar to liquidation value). Entire shipping industry is measured with NAV and how stock prices follow NAV.

Below if the historical movement of company’s stock price:

Source: Investing

The company’s stock price is usually at some discount to NAV. Below is the NAV and discount rate of the stock traded in the last 5 years:

Source: GE Shipping Presentation

NAV has 2 parts:

o Consolidated NAV presently of Rs.525/share

o Standalone NAV presently of Rs.475/share

Standalone NAV represents market value of the shipping business + cost of the offshore business appearing in the standalone. Hence this 475 consists of Rs.80 of offshore cost and balance 395 as market value of shipping.

Difference in the consolidated and standalone NAV of Rs.50 is attributed to the difference in the market value vs the cost of offshore. Hence the NAV of offshore is 130.

NAV in absolute terms: offshore is valued at 2000 crores (~300 crores EBIDTA and 400 crores of debt); shipping at 6000 crores (~1400 crores EBIDTA and 1000 crores of debt).

In future, the increase in the NAV can come from capital gains (movements in asset prices) and through the PL (yearly cash flows).

7. Financials:

o The company has generated positive cash flows from operations since last 20 years aggregating to more than 25000 crores, which proves that shipping is a cash generating business if ridden well.

o The net debt levels of the company are presently comfortable at 1500 crores.

o The company has maintained an average EBIDTA of 1200 crores in shipping and Rs.400 in offshore in last 5 years.

o The company has ridden the down cycle well (post 2008) by generating positive cash flows and adding the fleet size too, making it one of the finest shipping companies in the world.

o The company has paid dividend aggregating to ~4000 crores in the last 15 years.

Sensitivity:

Below is the snapshot of the TCYs achieved by the company in FY21 and also the spot rates going on the market:

With these base numbers let us do sensitivity analysis by increasing freight rates in 3 cases, because looking at the present spot rates, we think the freight rates have room to improve:

o Increase in freight rates triggers operating leverage and entire upside in the topline goes to the bottom line. In this case we have considered degree of operating leverage to be 75%.

o In scenario 1, the EBIDTA of the company (without scaling up the fleet size) can range up to ~3500 crores under case 3.

o In scenario 2, assuming 50% growth in fleet (which is possible over the next 2 years under organic route), EBIDTA of the company can jump to ~4000 crores in a decent pull back in freight.

o In scenario 3, assuming 100% growth in fleet (which is possible over the next 2 years under inorganic route), EBIDTA of the company can jump to 4000+ crores in case of even a small uptick in freight rates.

If the rise in freight rates remain strong for a few years (structural recovery), which we are hopeful of, then we will see strong cash flows over the next 5-7 years. In this case the company can earn anywhere between 15,000 to 30,000 crores of cash flows.

The above shows powerful is the combination of operating leverage and financial leverage.

Based on the above EBIDTA, we think there is a good upside available in the company’s stock price.

We have tried to calculate the NAV for the next 5-7 years based on estimated cash flows and capital gains as under:

6. Summary:

We like shipping sector and GE Shipping in that sector for the following reasons:

• Can’t get worse

• Longest down cycle in any commodity sector

• Most of the shipping companies and shipyards have gone bankrupt

• Supply side response is expected to be slow

• Lowest freight rates; only way is to go up

• Structural turn in the cycle

• Lowest order book

• High scrapping potential due to ageing fleet

• Carbon emission norms / IMO related disruption that will keep supply in check

• Tightness in accessing finance

• Spot market exposure

• Cheap valuations; re-rating candidate

• Re-leveraging story

• Last man standing in the sector (key assumption for any best cyclical stock)